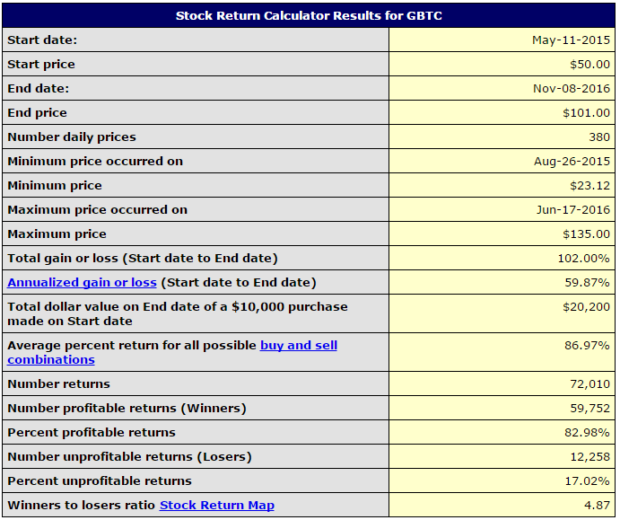

- The Bitcoin Investment Trust are up nearly 40% year to date / 102% since May 2015.

- Bitcoins are increasing being considered as a safe haven from vulnerable currencies. A capped supply reduces devaluation risks brought about by increases in supply.

- Bitcoin’s biggest risks are the security vulnerabilities of exchanges and wallet sites.

- You can add GBTC to your portfolio (or wait for COIN for even more liquidity) to help you mitigate currency and market volatility driven by political catalysts.

One of the unseen victors of Tuesday’s presidential elections was Bitcoin. BTC prices rose to over $720 per bitcoin on early news of a Trump win. Since then, prices have corrected and Bitcoins are trading at around $709 – where they were prior to the election. Shares of the Bitcoin Investment Trust (OTCQX:GBTC) rose to nearly $107 early Wednesday and have since likewise returned to the $101 level as of mid-day Thursday. What we’ve been seeing recently with the Brexit vote and China’s recent announcement to further devalue their currency is Bitcoin becoming a hedge against currency volatlity as parties with interests in important elections seek to hedge against market and currency volatility.

Opinions Are Mixed Regarding Bitcoin As A Safe Haven

All that seems to be good for Bitcoin which,due to recent monetary policy decisions by China, is being boosted by demand for safe havens after Trump’s suprise victory. Prices were up to $733 at one point after being stuck in the $700-$709 range since November 4. Crypto Compare CEO Charles Hayter wrote in an email to CNBC Wednesday morning: “Bitcoin is yet again acting as a form of digital gold and correlating strongly with the commodity – when there is uncertainty safe haven assets see a boost”. He also commented on the idea that the original crypto currency is seeing boosts in markets where markets can temporarily be rattled by unexpected political or economic catalysts: “As with Brexit, bitcoin is seeing an upward jolt on the back of Trump’s election and the resultant lack of clarity on the global stage,” he added.

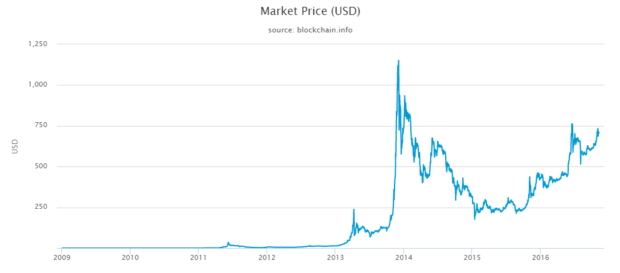

After Brexit, the price of Bitcoin jumped from $550 to $650. Not everyone feels the same way about Bitcoin. Gil Luria, director of research at Wedbush Securities disagees. He told Coinbase, a popular California-based bitcoin exchange this morning – “Bitcoin has plenty of risks that are unique to the technology, which is why it is best suited for investors that understand those risks,” Luria said. “I consider a safe-haven asset an asset that has inherent downside protection, which I do not believe bitcoin will have any time soon.” What you need to ask yourself before making that decision for yourself is if Bitcoin’s unique qualities as well as its ease of accessibility will be a future catalyst for growth by investors who don’t necessarily agree with the libertarian philosophy that has driven growth in Bitcoin since 2011. In regards to Bitcoin, the future is uncertain. Not all investors are convinced but the charts suggest there is still room for growth. Let’s take a look at some charts and what general trends we can determine when it comes to “the bigger picture”.

The above table gives us details about GBTC’s performance since it first starting trading in May of 2015. In that nearly year and a half, GBTC has returned 102%, or nearly 60% annualized. Bitcoin’s trends are overall creeping upwards.

Future Risk and Reward Catalysts

The Bitcoin Investment Trust and Winkelvoss Bitcoin Trust ETF (Pending:COIN) provide the opportunity to further diversify your save haven assets such as precious metals into cryptocurrency. There are a few good reasons to believe Bitcoin will remain an appreciating asset that can further improve portfolio’s yields. Here are three:

- Fiat currencies require increases in money supply to support inflation while gold and silver prices are driven in part by mining yields and industrial usage, but Bitcoin’s lifetime supply is capped to 21 million coins. On top of that, the rate of creation of new bitcoins was halved this summer from 25 bitcoins BTC per block to 12.5. That creates a decrease in supply growth – a structural feature designed to increase the digital currency’s value over time by eliminating supply-side depreciation risks.

- Greece, Venezuela, Argentina, Zimbabwe, Cyrpus… The list of fiat currencies losing purchasing with every blink of the eye can be partially attributed to sharp increases in money supply. Nations such as Mexico and Ecuador have been increasingly researching and developing blockchain techologies. China has held discussions with Citi (NYSE:C) and Deloitte and they’re already working on a blockchain. Tunisia has already implemented a national blockchain and Japan has embraced Bitcoin with open arms. On top of that, global corporate giants such as Microsoft (NASDAQ:MSFT), Dell, and Paypal (NASDAQ:PYPL) have publicly invested in blockchain tech with other corporate giants such as Alphabet Inc. (GOOG, GOOGL) and Apple Inc. (NASDAQ:AAPL) have been rumored to be working on implementing block chain tech into their future payment services strategies.

- In an increasingly global economy, using BTC payment remittance provides opportunities for even the smallest businesses to capitalize on purchasing services from anyone all over the world without the barriers to entry typically associated with sourcing global talent. It’s safe, secure, and it can be accessed by anyone with internet access.

Of course, many risks still exist in Bitcoin. Exchange hacks have sometimes cause the value to plummet, in large part due to the theft of over $450 million in bitcoins at the time, but Bitcoin has been resilient and moved forward with its agenda. Part of that has to do with the libertarian philosophy of competition in money. The likeliness of an alternative form of currency seemed like a slim chance at first. The industry of money was seen as a monopoly and Bitcoin provided the decentralized technology to limit control and regulation by governments over a competing currency something free market economists believe is essential for a free society to thrive economically. Whether or not you agree with the assessment, you can’t deny that Bitcoin is more and more becoming a store of value. The charts below display the volume of transactions in Bitcoin per day and the price of 1 BTC in USD. Both have been rising sharply since Bitcoin’s price bottomed out mid-2015.

The Bottom Line

Now is a good time to add Bitcoin to your portfolio. COIN, The Winklevoss Bitcoin Trust ETF, has yet to be approved by regulators although it is expected to eventually hit the market. What that will do is add the liquidity and open access that comes along with being listed in the U.S. equities market.

Aside from large hacks of and thefts from independently owned and operated Bitcoin exchanges, its innovation is very real and here to stay. Blockchain encryption technology is peaking a lot of interest in the FinTech industry and confidence in Bitcoin’s future value has been returning. Whatever your reservations about the risks and rewards of a digital currency are, BTC has seen a successful first five years as a remittance technology. The Bitcoin itself is highly robust. Its big selloffs were primarily due to embezzlement and thefts which exists in every form of money.

As investors, what we need to look at are the future prospects. The decentralized remittance technology does have its downsides including ecological implications. All those downsides, however, have to be weighed against its upsides. The lack of centralized control and ease of use provide us with a first of its kind – a technology allowing us to send money to anyone anywhere at any time at the click of a button. Its blockchain technology is becoming increasing popular as banking and financial giants begin to see the benefit in such a highly encrypted and low-cost method to remit transactions. I’m bullish on Bitcoin and the GBTC trust long term. Many new products backed by blockchain technology are coming and going but the Bitcoin is the original and, ultimately, blockchain technology is going to remain closely identified with Bitcoin for the foreseeable future. Adding GBTC to your portfolio can help you benefit from possible Bitcoin upside while reducing the risks associated with utilizing Bitcoin exchanges and wallets. Once COIN is trading, you’ll be able to harness the benefits of owning Bitcoin through an ETF.