The 2016 Macbook Pro Is Here

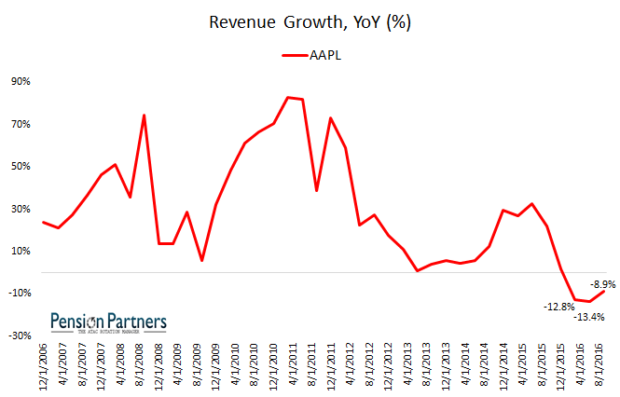

Apple Inc. (NASDAQ: AAPL) released the newest iteration of its OSX operating system earlier this week to complement the release of the 2016 line of Macbook Pro and Macbook Air notebooks. Along with the latest software and security updates, macOS Sierra included hidden Apple Pay images featuring the new Macbook Pro set to be announced by Apple later today (watch the event live). The announcement couldn’t have come sooner given Apple’s decline in revenue growth; After all, personal computer, specifically laptops are what made Apple famous and the pressure is on once again for Apple to deliver. Apple isn’t only out to please investors but also brand loyalists which has been holding off on purchasing new laptops in anticipation of the long awaited update to the brand’s most popular series of notebooks. The new line will feature updated hardware for more power, better batter life and a new design reminiscent of its predecessor but that’s not all Apple fans are excited about.

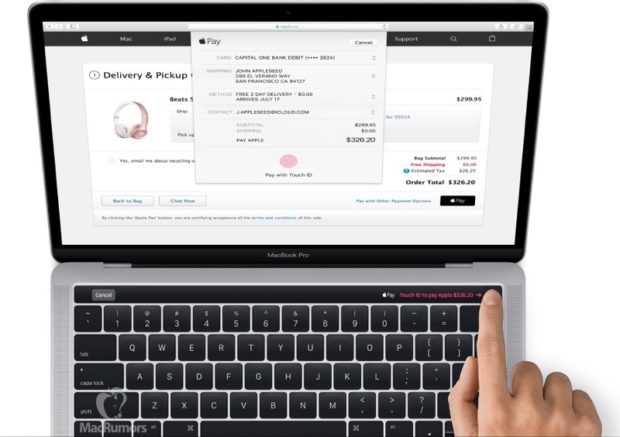

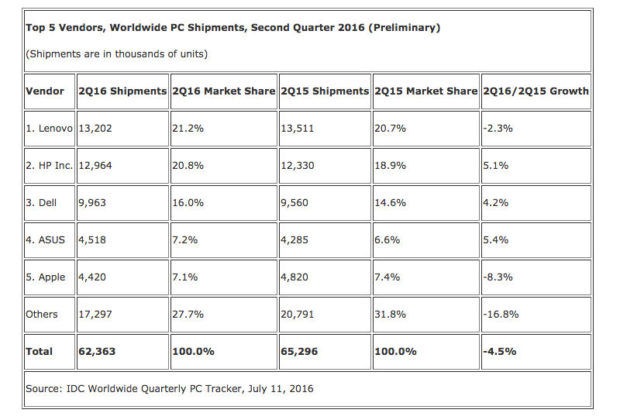

The new line of Macbook Pro laptops will feature a Magic Toolbar OLED Panel which will replace the escape and function keys. The panel will let you access unique features in programs as well as access user settings, options, and shortcuts. It will also feature touch ID and more. The new notebook will possibly will shrug its 3.5mm headphone jack in favor of USB-C just like the iPhone 7 has. Of course, a converter can be purchased. A new Macbook Air will be introduced as well. The question is: is it enough to restore investor confidence in Apple’s ability to move up the ranks in the list of top 5 PC manufactures? Macintosh branded PC shipments have declined 8.3% year over year. In the second quarter of 2015, Apple shipped 4.82 million units which amounted for 7.4% of market share. In the same time period this year, Apple shipped roughly 400 thousand less units and saw market share decline to 7.1%. Apple trails behind ASUS by .1%, and anywhere between 9 and 14 points behind Dell, HP and Lenovo.

Apple announced its fiscal Q4 earnings (which ends Sep. 24) yesterday and put a focus on iPhone shipments which beat analyst expectations by nearly 700,00 units (45.51 million to 44.8 million). Apple also reported upgraded guidance for Q1 2017 with expected revenues between $76 and $78 billion with a cash dividend of $0.57 per share. International sales accounted for roughly 62% of revenue weighed down by slow business in China which CEO Tim Cook has cited slow LTE adoption rates which he expects to turn around by Q2 2017. Services business grew 24% to $6.3 billion as well, setting the company’s all-time record growth in the segment featuring the apple store and content.

So, growth in iPhone shipments and app sales have been fueling growth in their segments but notebooks shipments, which were a huge contributing factor to Apple’ success in the 2000’s and preceded the iPhone as Apple’s most high-selling product, have been waning. Apple has timed this release right in time for the holiday season and will likely finish up the year strong. After all, many Apple enthusiasts have been holding off purchasing a new laptop in anticipation for the new Macbooks. Despite all that, Apple’s stock tumbled after the release and closed out Wednesday at $115.59 (-$2.66/-2.25%). Investors are mostly concerned about Apple’s future catalysts for growth especially given all the buzz regarding the downsizing of Project Titan, their still largely undisclosed R&D automotive project. Although unverified, rumors suggest Apple has given Project Titan until the end of 2017 to research and develop an automated driving system. Recent rumors of an acquisition of McLaren had investors hoping for faster than anticipated news on the project but a deal hasn’t been substantiated and rumors have suggested the project’s ambitions have been downsized.

Apple is really gearing up to see steady and consistent growth in virtually all product segments going into 2017. Apple can deliver better than expected growth in the laptop segment in Q1. Given the demand from enthusiasts and the holiday shopping season, the new line of notebooks will likely be on route for a great quarter. Whether or not that’s enough to drive a rally in the stock is up to debate but it’s still important to keep in mind that next quarter will see solid performance in virtually all segments and China might even start to show signs of turning around.

Apple doesn’t seem to be set to reveal any new products anytime soon and that’s part of the reason why some aren’t expecting Apple to deliver on the same type of constant growth it has over the last 20 years. My opinion is “So What?”. If the changes to the Macbook Pro are widely accepted, we’re talking serious growth potential in the segment. Aside from Asus, who ships just nearly as many PCs as Apple, Apple’s next competitor in the PC industry would be Dell, which shipped nearly twice many PCs as Apple in Q2. Apple does have the opportunity here regain market share in the PC space and can build on notebook sales momentum with introduction of a new iMac early in 2017. In other words, if this thing is a hit, Apple will be raking in some serious cash.

AAPL has been trading a few bucks short of its six-month high near $118 but has been building steady momentum throughout the month despite the news on Project Titan. The stock is still roughly $8 away from its 52-week high of $123.82. Buying opportunities exist if you believe a turnaround in revenue growth can be fueled by growing computer and iPhone sales. If you’re waiting hints of the next big thing from Apple to signal a buy, you’ll be waiting for a while just like the rest of us.